Why Daily Loss Limits Protect Your Account (2026 Trading Reality)

In the 2026 trading environment, volatility is compressed and then suddenly explosive. Markets move slowly for hours and then expand aggressively within minutes during macro releases, session overlaps and liquidity sweeps.

Many traders focus on strategy optimization. Few focus on daily loss protection. But the uncomfortable truth is simple: daily loss limits protect your account more than any entry model ever will.

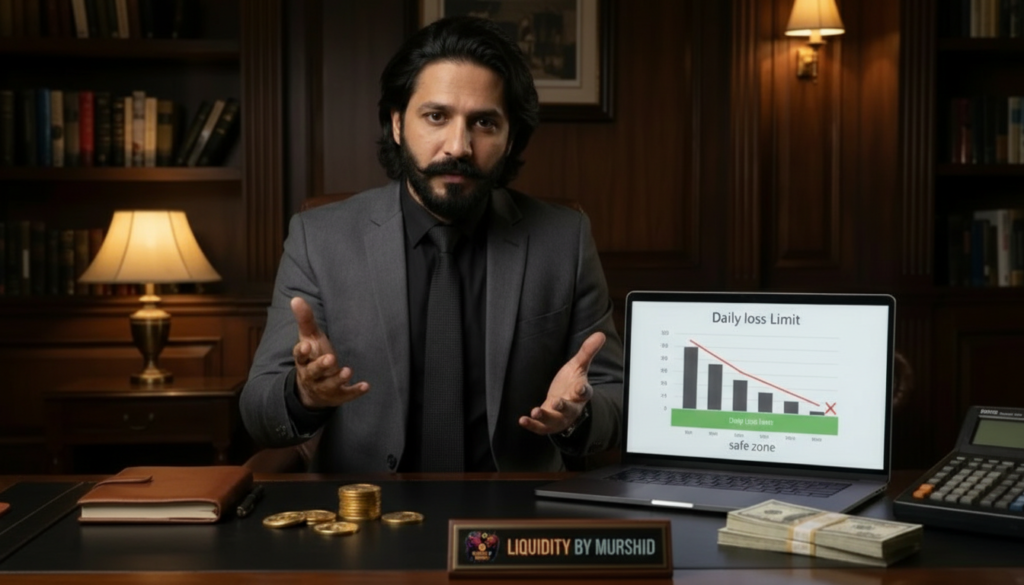

A daily loss limit is a predefined maximum amount of capital you are willing to lose in a single trading day. Once that number is reached, trading stops. No exceptions.

If you want structured weekly protection, review how to create a safe weekly risk profile in 2026 first.

The 2026 Market Problem: Volatility Clusters

As of February 2026, markets continue reacting sharply to CPI, NFP and central bank guidance. Liquidity hunts are more frequent. False breakouts are more aggressive.

This creates a dangerous pattern:

- Early loss during low liquidity session.

- Emotional attempt to recover during high volatility.

- Larger second loss due to expansion.

Without a daily limit, small losses quickly compound into structural damage.

Daily Loss Limits Stop Emotional Escalation

After two losing trades, decision quality declines. This is not opinion. It is behavioural reality. Traders begin increasing size, forcing entries or trading outside plan conditions.

A daily loss limit removes the option to escalate. It enforces discipline automatically.

This is especially important after liquidity traps, as discussed in understanding liquidity traps.

Mathematical Protection Against Drawdown Acceleration

Drawdowns accelerate when losses stack in a short period. A trader risking aggressively without daily limits can experience a 10–15% loss in one session.

Daily loss limits:

- Cap exposure during unstable sessions.

- Protect weekly performance consistency.

- Reduce compounding damage.

Mathematics favours controlled exposure, not aggressive recovery attempts.

Liquidity Regime Shifts Can Destroy Unprotected Accounts

Markets rotate between expansion and compression phases. During regime shifts, strategies temporarily underperform.

Without daily protection, traders:

- Increase frequency after losses.

- Ignore structure shifts.

- Trade outside optimal sessions.

Structured traders accept temporary underperformance and protect capital. This aligns with the mindset explained in account survival vs account growth.

Professional Traders Think In Risk Units, Not Trades

Retail traders count trades. Professionals count risk units.

A typical structured model includes:

- Maximum daily percentage risk.

- Maximum number of trades per session.

- Shutdown rule after consecutive losses.

This ensures no single day can significantly damage long-term equity.

Daily Limits Improve Psychological Stability

Trading without limits creates anxiety. Every loss feels urgent. Every setup feels like recovery.

Daily limits create clarity:

- You know the worst-case scenario for the day.

- You stop before emotional fatigue builds.

- You return the next session mentally stable.

Discipline improves performance more than constant strategy adjustments.

How To Set A Proper Daily Loss Limit

Daily limits should be realistic. They must align with your weekly risk profile.

Structured approach:

- Define maximum weekly drawdown first.

- Allocate a fraction of that per day.

- Stop trading immediately once reached.

Consistency is built by stopping early, not by recovering aggressively.

Conclusion Protection Is The Real Edge

In 2026 markets, volatility and liquidity manipulation are normal. Losses are inevitable. What matters is controlling their size and frequency.

Daily loss limits protect your capital, your psychology and your long-term performance. Without them, even strong strategies eventually collapse under emotional pressure.

To build structured liquidity-based risk frameworks designed for modern markets, visit Liquidity By Murshid.