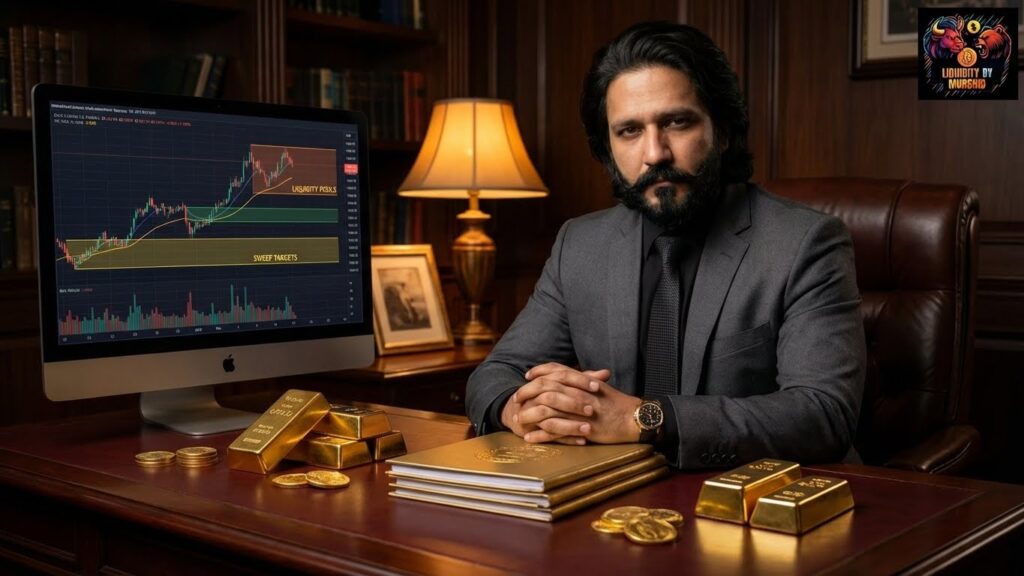

Weekly Gold Outlook Liquidity Pools Bias And Sweep Targets

Gold XAUUSD remains one of the most liquidity-driven instruments in global markets. Every week, price builds new liquidity pools, forms fresh bias, and creates clear sweep targets that institutions aim to attack. Understanding these elements is essential for predicting weekly direction and anticipating price movement with precision.

Unlike traditional technical analysis that relies on indicators, smart money traders focus on how liquidity builds and where price must move to collect orders. This makes weekly gold analysis far more accurate, structured, and systematic. When traders understand liquidity pools, sweep levels, and weekly bias, gold becomes far easier to trade with confidence.

For deeper smart money education on XAUUSD, visit

Liquidity By Murshid and access advanced liquidity-based courses.

Understanding How Gold Forms Weekly Liquidity Pools

Liquidity pools are areas where stop losses, pending orders, and trapped traders accumulate. Price seeks these zones every single week. Gold, due to its volatility and institutional volume, forms some of the clearest liquidity pools in the forex market.

Weekly liquidity pools often form near:

Previous weekly high Previous weekly low Daily range extremes Session highs and lows Equal highs or equal lows Imbalances or fair value gaps Psychological zones such as 2000 or 2050

Institutions target these areas because they contain the highest concentration of orders. Gold rarely begins a new weekly trend without first taking out one side of liquidity. This is why understanding weekly liquidity structure is the first step to forming directional bias.

Why Weekly Liquidity Matters More Than Intraday Levels

Intraday liquidity changes quickly, but weekly liquidity holds significantly more weight. Weekly highs and lows attract billions of dollars of orders. When price approaches these levels, the reaction is stronger, cleaner, and more predictable.

Weekly liquidity levels reveal:

Where the major sweep is likely to occur Where institutions will gather orders Where the weekly bias will originate Which direction has higher probability

Gold almost always sweeps one side of the weekly range before delivering the main move. Traders who track this behavior gain a major advantage over those who rely only on small intraday patterns.

Weekly Bias How Institutions Decide Direction

Weekly bias refers to the expected direction of gold for the current week. Institutions set this bias based on macroeconomic expectations, liquidity positioning, and previous weekly data.

To identify weekly bias, traders analyze:

Last week’s high and low Where liquidity currently sits Current weekly opening price Fair value gaps on the weekly chart Major economic events this week Relationship between gold and the US Dollar Index

If gold opens the week near a weekly low, institutions may push price upward to sweep internal liquidity before reversing. If gold opens near the weekly high, a downward sweep becomes likely. Understanding this interaction allows traders to anticipate future movement with greater accuracy.

Internal Versus External Weekly Liquidity

Gold does not simply target liquidity randomly. It follows a structured flow between internal and external liquidity. Internal liquidity forms inside the range, while external liquidity exists above the high or below the low.

Internal liquidity includes:

Minor swing highs Minor swing lows Pullback liquidity Small fair value gaps Inducement structures

External liquidity includes:

Previous weekly high Previous weekly low Major stop clusters Obvious double tops or bottoms Clean liquidity pools

The rule is simple. Internal liquidity is inducement. External liquidity is the real target. Institutions typically take both internal and external liquidity during the weekly cycle, but external liquidity carries the highest probability.

How Weekly Liquidity Sweeps Shape Gold Movement

A liquidity sweep occurs when price spikes into a liquidity zone, triggers stop losses, and then reverses. Gold performs liquidity sweeps more aggressively than almost any other asset due to its institutional volume and high volatility.

Weekly sweeps typically happen at:

Previous week’s high Previous week’s low The opening price of the week Major news events

These sweeps form the foundation of the weekly trend. A sweep of the weekly low often marks the beginning of a bullish move. A sweep of the weekly high often initiates a bearish correction or trend.

Sweeps are not accidents. They are engineered moves to collect liquidity and fuel larger directional pushes.

Weekly Sweep Targets to Watch in XAUUSD

Sweep targets are areas where liquidity is resting and price is likely to attack. Understanding these levels helps traders predict weekly moves with precision.

Common sweep targets include:

Equal highs around previous tops Equal lows around previous bottoms Liquidity above news-event highs Liquidity below sharp rejection lows Weekly fair value gaps Weekly imbalance zones

For example, if gold forms clean equal highs early in the week, expect a sweep later in the week before any major reversal. Likewise, a strong imbalance left on the weekly chart often becomes a magnet for price.

How Economic Events Influence Weekly Liquidity

High impact economic events significantly influence gold’s weekly direction. Events such as Non Farm Payroll, CPI inflation data, FOMC meetings, and unemployment reports create major liquidity traps and sweeps.

Price often consolidates or builds liquidity before these events and sweeps one side immediately afterward. Traders must understand how macroeconomic catalysts influence weekly liquidity.

For example, CPI data regularly shifts gold volatility and triggers sweeps at weekly highs or lows. Historical data from

the US Bureau of Labor Statistics shows consistent volatility spikes following inflation announcements.

Combining Weekly Bias With Intraday Execution

Weekly analysis provides the direction. Intraday timeframes provide the entry. This combination is one of the most powerful techniques in smart money trading.

Weekly bias tells you whether to look for buys or sells. Intraday timeframes such as:

H4 H1 M15 M5

tell you exactly when to enter after the sweep or displacement occurs. Smart traders do not guess direction. They align both the weekly and intraday narrative before executing.

Conclusion Reading Weekly Gold Liquidity for Precision Trading

The weekly outlook for gold becomes far more predictable when traders understand liquidity pools, weekly bias, and sweep targets. Gold does not move randomly. It follows a structured liquidity flow each week, engineered by institutional players.

By focusing on where liquidity is building, where imbalances lie, and where the market must deliver price, traders can forecast direction with high confidence. Weekly liquidity analysis is one of the strongest tools for XAUUSD traders who rely on smart money concepts.

To learn professional weekly liquidity analysis and master gold trading, explore the advanced lessons at

Liquidity By Murshid.