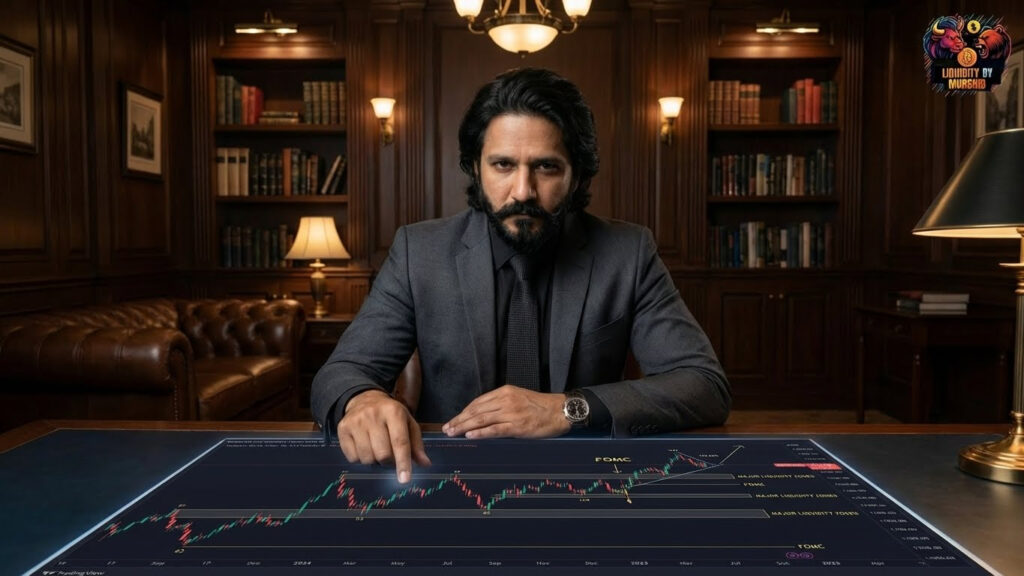

Major Liquidity Zones Ahead Of FOMC

The Federal Open Market Committee FOMC meeting is one of the most influential events in global financial markets. Every FOMC session brings volatility, sharp liquidity sweeps, engineered manipulation, and major directional moves. Smart money uses the days before FOMC to build liquidity, trap traders, and position the market for aggressive expansion once the announcement is released.

Whether you trade XAUUSD, BTC, or major forex pairs, understanding liquidity zones ahead of FOMC is crucial. These zones act as magnets for price and reveal exactly where institutions intend to move the market. In this weekly breakdown, we analyze the most important liquidity levels that are likely to be targeted before and after the FOMC decision.

To learn advanced liquidity concepts for XAUUSD and other markets, visit Liquidity By Murshid.

Why FOMC Creates Explosive Liquidity Events

FOMC determines interest rates, monetary policy direction, and future economic guidance. These decisions influence inflation, risk sentiment, and capital flows across all markets. Because of this, FOMC days generate massive volatility as institutions rebalance positions.

According to market impact studies from the Federal Reserve, liquidity thins out before the announcement and then floods into the market during the press conference. This creates predictable patterns: price consolidates before the event, liquidity builds on both sides, a sweep occurs minutes before or after the announcement, and the real move begins after liquidity collection.

Smart money uses this dynamic to manipulate liquidity and engineer clean directional moves.

The First Liquidity Zone Weekly High And Weekly Low

The most influential liquidity zones ahead of FOMC are the weekly high and weekly low. Institutions almost always sweep one of these levels before selecting the true direction. These extremes hold the largest concentration of stop losses and pending orders.

If gold is trading near the top of its weekly range, expect a liquidity sweep above the weekly high before the FOMC event. If gold is sitting near the weekly low, expect a downside sweep. These sweeping behaviors create cleaner bias for traders because they set the stage for the real post FOMC trend.

BTC and ETH follow this same approach by sweeping weekly ranges before choosing direction.

Liquidity Zones Above Daily Highs

Daily highs serve as strong external liquidity pools. Ahead of FOMC, gold frequently forms tight consolidation while building equal highs or minor rejection highs. These levels act as magnets hours before the announcement.

Gold traders should watch for equal highs forming in the Asian session, price consolidating below a daily high, wicks that almost tap the high but reverse, and a sudden pre FOMC spike above the high.

This spike usually grabs liquidity, clears stops, and prepares the chart for either a reversal or a strong continuation move after the announcement.

Liquidity Zones Below Daily Lows

Just like daily highs, daily lows contain massive liquidity pools. Retail buyers often place stop loss orders below these lows, making them attractive targets for institutional sweeps.

Ahead of FOMC, watch for sideways movement above a major daily low, multiple attempts to tap the low, liquidity building through equal lows, and price spikes below the low before reversing.

This behavior is classic inducement, preparing the chart for the real post event move. Gold, BTC, and major forex pairs all show this pattern ahead of major news.

Internal Liquidity Inside The Pre FOMC Range

Internal liquidity forms during the build up to FOMC. The market often stays inside a tight range during the first half of the week. This internal liquidity creates inducement traps for early traders.

Internal liquidity includes minor swing highs, minor swing lows, small fair value gaps, tiny order blocks, and consolidation mid range levels.

Smart money uses these internal liquidity pockets to engineer sharp spikes. Traders who enter too early get swept out as the market collects their stops before delivering the real move.

SPX Psychological and Technical Levels

Crucial Resistance: $4,244 USD. A break above this level could indicate a strong bullish continuation, potentially leading to a retest of historical highs.

Nearby Barrier and Neutrality Zone: $4,124 USD. This aligns with the 23.6% Fibonacci retracement and is a potential short-term range boundary if broken.

Critical Support: $4,000 USD. This is the most important psychological level. It also converges with:

- 38.2% Fibonacci retracement

- 50-period moving average

A sustained break below this point would signal a significant risk to the current uptrend.

Bitcoin BTC Psychological Levels

Bitcoin is currently hovering around $93,000 after a period of high volatility.

Key Psychological Resistance: $100,000

- This is a major psychological milestone.

- It has been a pivotal resistance level throughout the year.

- A sustained break and hold above this could trigger significant upward momentum toward $110,000 or $111,000.

Key Psychological Support: $80,000 – $87,000

- The price recently found support around the $80,000–$84,000 range.

- The $87,000 level represents a significant support zone where bulls have historically shown interest.

Ethereum ETH Psychological Levels

Ethereum is trading near $3,050, having recently bounced from lower levels.

Key Psychological Resistance: $3,000 – $3,200

- The $3,000 level is a critical point.

- Maintaining price action above this is essential for a bullish short-term bias.

- A confirmed close above this range could lead to a rally toward $3,500.

Key Psychological Support: $2,700 – $2,800

- The $2,800 level has acted as a key pivot during recent declines.

- The $2,700 to $2,749 area shows strong buying interest.

- A breakdown below this could risk a further drop toward $2,100.

Fair Value Gaps As Liquidity Targets Before FOMC

Fair Value Gaps FVGs act as powerful liquidity zones. Smart money uses FVGs to rebalance price before major news. When an FVG sits above or below the current range, expect price to tap it before or during the FOMC move.

Gold often fills major H1 or H4 FVGs hours before the announcement. This helps institutions position themselves for the post event expansion.

If a large FVG remains unfilled, it often becomes a magnet during the immediate FOMC spike.

Market Structure Liquidity Shifts Before FOMC

Understanding market structure ahead of FOMC is essential. The market often forms a fake structure in the days leading into the event. This fake structure is designed to lure retail traders into the wrong direction so their stops can be used as liquidity.

Key signs of pre FOMC structure shifts include a fake break of structure, a false trend created mid week, equal highs or equal lows forming, and sharp sweeps during low volume sessions.

Once the sweep occurs, smart money delivers the real displacement move during or after the announcement.

Major Sweep Targets To Watch During FOMC

Some sweep targets are more important than others. These zones are where institutions will almost certainly hunt liquidity before selecting direction.

Key sweep zones for XAUUSD include previous weekly high, previous weekly low, the prior FOMC high or low, London session high, New York session low, and H4 imbalance zones.

Key sweep zones for BTC and ETH include daily equal highs, weekly lows, range extremes on H4, and large liquidation clusters.

Major forex pairs also follow this pattern, especially EURUSD and GBPUSD.

Conclusion Mapping Liquidity Zones Ahead Of FOMC

FOMC week is one of the most profitable and most dangerous weeks for traders. Those who understand liquidity behavior gain a huge advantage. Those who trade blindly get caught in manipulation. Liquidity zones reveal exactly where smart money plans to move the market.

By identifying major liquidity pools, focusing on sweep targets, and understanding how institutions position price before economic announcements, traders can anticipate volatility and enter with confidence.

For advanced liquidity training and XAUUSD smart money education, visit Liquidity By Murshid.