Articles

- Home

- Articles

Fair Value Gaps vs Liquidity Zones

Fair Value Gaps vs Liquidity Zones (Key Differences In 2026 Markets) In the 2026 trading environment, two concepts dominate smart money discussions: Fair Value Gaps

Internal vs External Liquidity Explained With Examples

Internal vs External Liquidity Explained With Real Market Examples (February 2026) As of February 2026, liquidity continues to be the primary driver behind every major

The Difference Between Account Growth And Account Survival

The Difference Between Account Growth And Account Survival In today’s 2026 market environment, traders have more access, leverage and opportunity than ever before. Yet despite

Why You Don’t Need Indicators When You Understand Liquidity

Why You Don’t Need Indicators When You Understand Liquidity In January 2026, global financial markets are faster, more automated and more liquid than ever before.

Manual Versus Automated Trading Which Suits You In 2026

Manual Versus Automated Trading Which Suits You In 2026, trading has clearly split into two worlds. On one side, algorithms, AI bots and copy trading

Gold Manipulation vs Liquidity Reality

Gold Manipulation Versus Liquidity Reality Gold has entered a new regime. In January 2026, spot gold printed fresh record highs above $4,600 per ounce as

Why Most Traders Blow Accounts The Liquidity And Risk Truth

Why Most Traders Blow Accounts The Liquidity And Risk Truth By 2026, markets have never been more liquid or more dangerous. Gold has traded above

Crypto Liquidity Zones Explained For 2026 Traders

Crypto Liquidity Zones Explained Crypto is no longer a thin, purely retail market. In early 2026, Bitcoin trades around the $90,000 region and Ethereum is

How Liquidity Concepts Apply To Bitcoin And Ethereum In 2026

How Liquidity Concepts Apply To Bitcoin And Ethereum Bitcoin and Ethereum are no longer just speculative coins; they are deep, institutional markets. With spot ETFs,

NFP Week Where Stops Are Resting On Gold And Major Pairs

NFP Week Where Stops Are Resting Every first Friday, the US Non Farm Payrolls release turns into a global liquidity event. In 2025 that effect

FOMC Week Key Gold Liquidity Zones For XAUUSD Traders

FOMC Week Key Gold Liquidity Zones During FOMC week, gold does not move in a straight line. XAUUSD rotates between tight ranges, sharp fake moves

Most Important Liquidity Events To Expect In January 2026

Most Important Liquidity Events To Expect In January 2026 January 2026 will open the year with a cluster of high impact economic releases and central

Crypto Market Recap Weekly Liquidity Review December 2025

Crypto Market Recap Weekly Liquidity Review December 2025 The first week of December 2025 opened with a violent flush across the crypto market and ended

Gold Weekly Recap What Smart Money Did This Week On XAUUSD

Gold Weekly Recap What Smart Money Did Around 4200 This week, gold XAUUSD spent most of its time orbiting the key 4200 US dollar handle.

Liquidity Map For The Week Key Zones Across Major Pairs

Liquidity Map For The Week Key Zones Across Major Pairs If you start your trading week by staring at random candles, you are already behind

Global Risk Sentiment and Impact on Gold in December 2025

Global Risk Sentiment And Impact On Gold In December 2025 Global markets in December 2025 sit in a strange balance. On one side, investors are

CPI Week How To Prepare For Volatility In December 2025

CPI Week How To Prepare For Volatility In December 2025 December 2025 is closing out a year of constant macro surprises. US inflation has been

NFP Week Key Levels and Market Expectations

NFP Week Key Levels And Market Expectations Non Farm Payroll NFP week is one of the most volatile periods in the financial markets. Every first

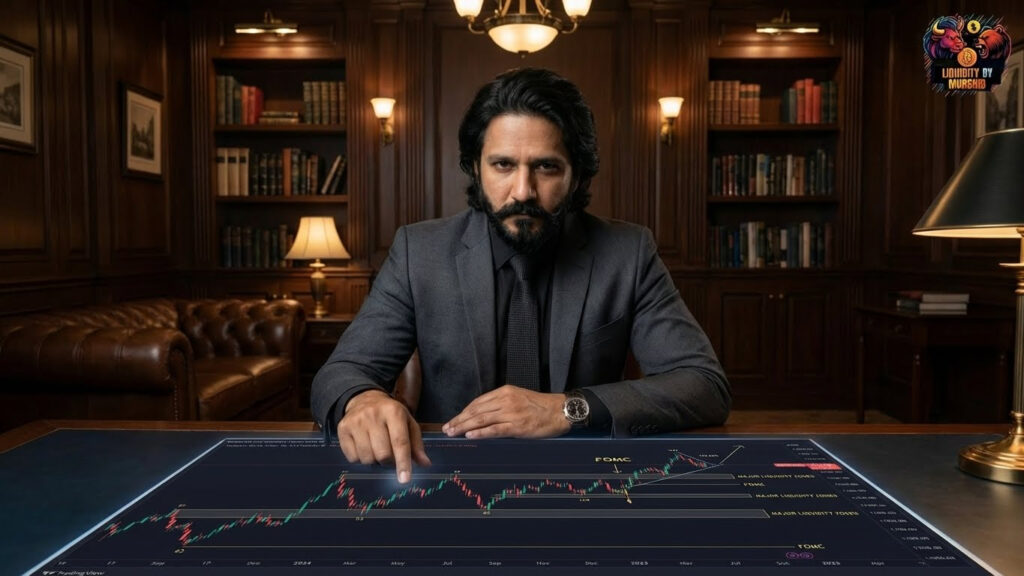

Major Liquidity Zones Ahead of FOMC

Major Liquidity Zones Ahead Of FOMC The Federal Open Market Committee FOMC meeting is one of the most influential events in global financial markets. Every

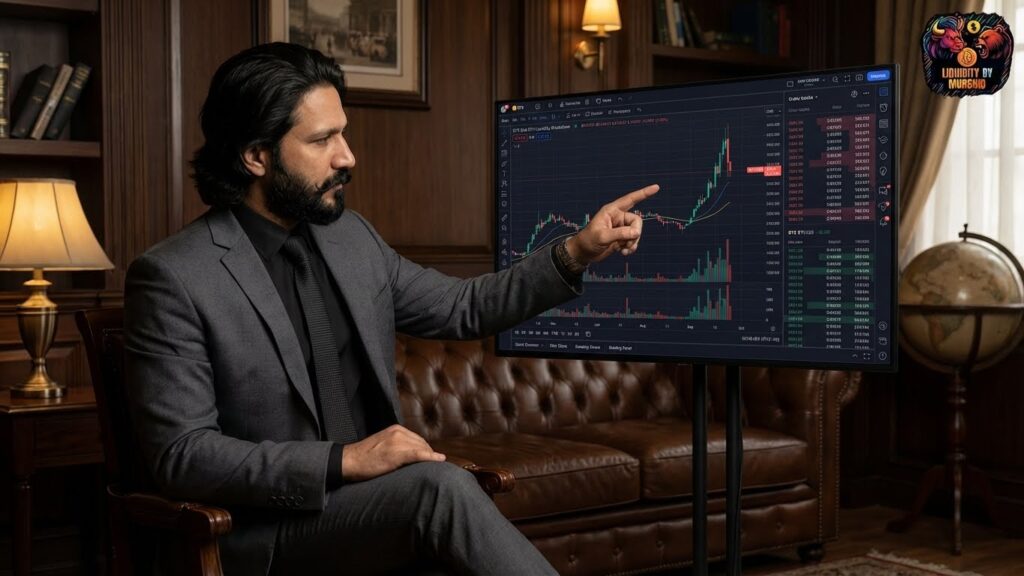

BTC and ETH Liquidity Breakdown What Smart Money Is Targeting

BTC And ETH Liquidity Breakdown What Smart Money Is Targeting Bitcoin BTC and Ethereum ETH remain the most heavily traded assets in the crypto market.

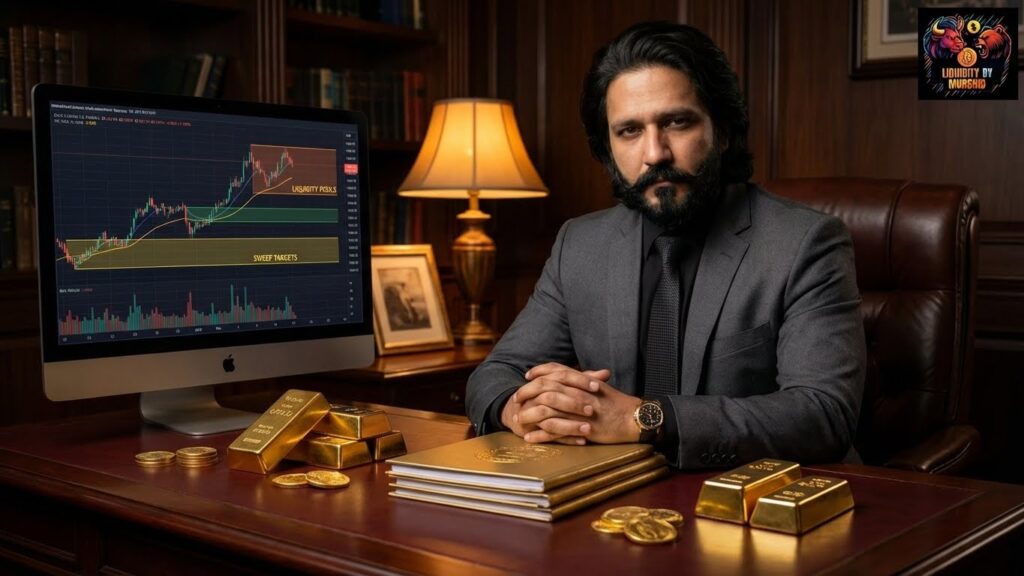

Weekly Gold Outlook Liquidity Pools Bias and Sweep Targets

Weekly Gold Outlook Liquidity Pools Bias And Sweep Targets Gold XAUUSD remains one of the most liquidity-driven instruments in global markets. Every week, price builds