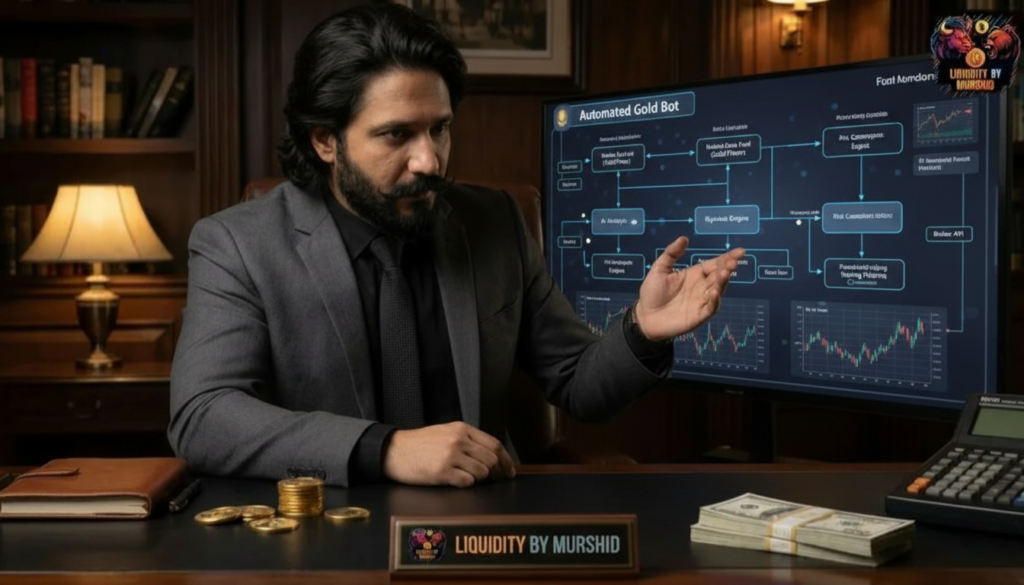

How Automated Gold Bots Work Behind The Scenes

In the 2026 trading environment, automation is no longer a luxury. It is a structural advantage. Gold markets move quickly around liquidity events, economic releases and institutional sessions. Manual execution often reacts late. Automated gold bots are designed to remove hesitation and execute based on predefined logic.

But behind every automated strategy is a structured framework. Gold bots do not randomly enter trades. They operate on liquidity models, risk parameters and execution rules that mimic professional trading behaviour.

This article explains how automated gold bots work behind the scenes, how they identify opportunity and how disciplined automation differs from reckless algorithmic gambling.

For structured execution systems built around real liquidity behaviour, explore the education at Liquidity By Murshid.

Step One: Market Structure And Liquidity Mapping

Professional gold bots begin with structure. They track higher timeframe bias, internal and external liquidity pools and areas where stops are likely resting.

Most structured bots are programmed to:

- Identify equal highs and equal lows.

- Mark liquidity voids and imbalances.

- Detect shifts in market structure.

These concepts are similar to what is explained in how liquidity drives every market move in forex. The difference is that a bot executes instantly once conditions align.

Step Two: Entry Confirmation Logic

Automated gold bots do not simply buy or sell at liquidity. They wait for confirmation. This confirmation is rule based, not emotional.

Common confirmation conditions include:

- Liquidity sweep followed by displacement.

- Break of internal structure.

- Return into fair value gap or premium/discount zone.

These models reflect principles discussed in the role of imbalance and fair value gaps in trade execution.

Step Three: Risk Management Programming

The true power of an automated gold bot is not entry precision. It is risk control. Professional automation strictly defines position size, stop placement and weekly exposure.

Behind the scenes, bots calculate:

- Fixed percentage risk per trade.

- Maximum daily loss limits.

- Maximum weekly drawdown thresholds.

This aligns with structured approaches outlined in how to create a safe weekly risk profile in 2026.

Step Four: Session And Liquidity Filters

Not all hours are equal in gold trading. Institutional liquidity is concentrated around London and New York sessions. Well designed bots avoid low volume conditions.

Behind the scenes, bots may:

- Trade only during high liquidity sessions.

- Avoid major news minutes.

- Reduce size during high volatility weeks.

Understanding optimal gold timing is discussed in best time to trade gold based on liquidity.

Step Five: Execution And Order Handling

Execution speed matters in gold markets. Automated bots connect through APIs to trading platforms and send market or limit orders instantly when criteria are met.

Advanced bots include:

- Slippage protection logic.

- Spread filters.

- Partial profit scaling rules.

The goal is not frequency. The goal is precision execution aligned with liquidity behaviour.

The Difference Between Structured Bots And Gambling Algorithms

Many retail traders misunderstand automation. A bot without liquidity logic is simply fast gambling. Structured automation follows rules grounded in market mechanics.

Disciplined bots:

- Trade less but with defined bias.

- Respect drawdown limits.

- Align with higher timeframe structure.

Reckless bots overtrade, martingale and ignore liquidity context. Eventually, they fail.

Conclusion Automation Is Discipline Encoded

Automated gold bots work behind the scenes by encoding structure, liquidity mapping, confirmation logic and strict risk management into software rules. They remove hesitation but they do not remove responsibility.

When automation is built on liquidity principles, it becomes a powerful execution assistant. When built on greed, it becomes accelerated risk.

To understand how professional liquidity based systems are designed for gold markets, visit Liquidity By Murshid.